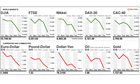

Stock markets stage tentative recovery

• FTSE 100 up 20 points after Thursday’s 246-point loss • UK bank shares in positive territory • Asian markets fell overnight • Norman Lamont warns world economy ‘on the brink’ Shares in London and the rest of Europe staged a tentative recovery on Friday, after a pledge from the leaders of the G20 countries to step in to help financial markets. Finance ministers and central bankers from the group of 20 major economies vowed on Thursday night to take “all steps necessary” to calm the global financial system and said central banks stood ready to supply liquidity. They also indicated that the eurozone was working on bolstering the €440bn (£385bn) financial rescue fund. The communique said the bloc would implement “actions to increase the flexibility of the EFSF and to maximise its impact” by the group’s next ministerial meeting in October.” Meanwhile, David Cameron warned the global economy was close to “staring down the barrel” and told eurozone leaders to stop “kicking the can down the road”. Stock markets suffered heavy losses on Thursday, when £64bn was wiped off the value of blue-chip stocks in London and the FTSE 100 index closed down 4.7%. The FTSE opened 50 points higher on Friday, then turned negative before rising 19 points to 5062. Banking stocks Lloyds Banking Group, Barclays and HSBC were among the top risers. French banks, which are heavily exposed to Greek sovereign debt, also bounced back, with Société Générale, Credit Agricole and BNP Paribas up between 1.9% and 3.9%. Jane Foley, senior currency strategist at Rabobank, said: “The statement from the G20 may have taken the edge off the current bitter market sentiment but the reassurances from the finance ministers lack substance. Until politicians back their words with actions in respect to moving closer to a solution to the eurozone debt crisis, markets will continue to worry about a messy and painful outcome from the eurozone debt crisis and flight to quality is set to remain the order of the day.” In Asia, shares continued their slide. Hong Kong’s Hang Seng was down 0.7% while the south Korean stock market lost 5.7% and the Taiwanese market fell 3.6%. The Greek finance minister, Evangelos Venizelos, told lawmakers he saw three scenarios to resolve the debt crisis, including one where the country obtains an orderly default with a 50% haircut for bondholders, two Greek newspapers have reported. The other scenarios would a be a disorderly default or the implementation of a second €109bn (£95bn) bailout plan agreed between Greece and its lenders in July. Echoing Cameron’s comments, former chancellor Norman Lamont said the world was “teetering on the brink”. While the growth problem cannot be solved easily, “the problem of Greece could be solved either by having a controlled default or bailing it out,” he argued on the BBC’s Today programme. “The logic of currency unions is that the stronger countries help the weaker countries.” But he was sceptical that this would happen soon. “The crisis will just drag on and on, sapping confidence.” Commodities continued their sell-off, with the London copper price hitting its lowest level in more than a year. It is on course for its steepest weekly loss since October 2008. Michael Hewson, market analyst at CMC Markets, said: “The outlook for the European banking system remains highly uncertain with downgrades for seven Italian banks, uncertainty over the next tranche of the Greek bailout, and an IMF report suggesting that the recent crisis in Europe suggests that the banks could be undercapitalised to the tune of €300bn and that politicians need to act now to avert a crisis.” Stock markets Global economy Economics G20 Julia Kollewe guardian.co.uk