Republicans Call for Gutting Social Security, Adding Trillions to Debt

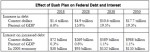

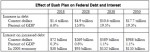

enlarge Credit: Center on Budget and Policy Priorities Over the past few weeks, the political chattering classes have been abuzz over 2012 GOP frontrunner Rick Perry’s claim that Social Security is a “Ponzi scheme.” ( It isn’t .) But largely overlooked in the parsing and the polls is the ocean of red ink the various Republican Social Security privatization schemes would inevitably produce. More than a decade after George W. Bush first proposed them, there’s no escaping the fact that private accounts would divert trillions of dollars from Social Security and thus build a new mountain of federal debt. It is important to note for starters that Social Security is not in crisis, despite Perry’s claims that the system is ” a monstrous lie ” and ” bankrupt .” With a $2.5 trillion surplus, as the New York Times noted, “Government projections have Social Security exhausting its reserves by 2037, absent any changes, but show that the payroll tax revenues coming in would cover more than three-quarters of benefits to recipients then.” With simple changes to benefits, eligibility and most importantly, funding, Social Security can easily be made sound for generations to come. Citizens for Tax Justice and the New York Times each estimated that extending the payroll tax to income over $250,000 a year (as candidate Obama and Vermont Senator Bernie Sanders proposed) would deliver about $50 billion annually in new revenue for the Treasury. And as the Times suggested in November , the move is long overdue: When the payroll tax – which finances Social Security and Medicare – was created, it covered 90 percent of all income. Today, with a ceiling at $106,800, it covers closer to 80 percent. Nevertheless, as the AP reported Saturday, when it comes to Americans’ retirement security, Republican presidential candidates are returning to a bad idea whose time never came. Most of the top Republicans running for president are embracing plans to partially privatize Social Security, reviving a contentious issue that fizzled under President George W. Bush after Democrats relentlessly attacked it… Former Massachusetts Gov. Mitt Romney has a version. Reps. Michele Bachmann of Minnesota and Ron Paul of Texas have said younger workers should be allowed to invest in alternative plans. Texas Gov. Rick Perry has raised the idea of letting whole groups, such as state and local government workers, opt out of Social Security. These proposals are popular among conservatives who believe workers could get a better return from investing in publicly traded securities. But most in the Republican race have been careful to say they would fight to preserve traditional Social Security for current retirees and those approaching retirement. Younger workers, they say, should have more options. Options, that is, to massively increase the U.S national debt while putting their retirement investments – and billions in management fees – in the hands of Wall Street firms. As Matthew Yglesias described one aspect of the problem for the would-be Republican reformers: What privatizers want to say is that current retirees will keep getting benefits and future retirees will be okay despite our lack of benefits because we’ll have private accounts. But current retirees can’t get benefits if my money is in a private account. And my account can’t be funded if I’m paying benefits for current retirees. As it turns out, Vice President Al Gore made the same point during his presidential debates against then Governor George W. Bush. “Because the trillion dollars that has been promised to young people has also been promised to older people,” Gore explained, adding, “And you cannot keep both promises.” And by diverting money to private accounts from the Social Security trust-fund, Republicans also can’t keep their born-again promises to lower the national debt . In 2005, James Horney and Richard Kogan of the Center on Budget and Policy Priorities totaled up the fiscal hemorrhaging that would ensue from the privatization plans of President Bush and other Republicans: The President’s plan would create $17.7 trillion in additional debt by 2050. This additional debt would be equal to 19.3 percent of the Gross Domestic Product in 2050. Despite the public’s overwhelming rejection of his plan in 2005, George W. Bush later saw it as a major domestic policy achievement. “Bush,” right-wing water carrier Fred Barnes noted, “said his effort showed it’s politically safe to campaign on changing Social Security and then actually seek to change it.” Despite the collapse of Wall Street, 2008 Republican nominee John McCain apparently felt the same way. And ThinkProgress reported at the time, studies estimated that private accounts would lose money a third of the time. That fall, the Center for American Progress calculated that “that if a worker had retired on October 1, 2008 after 35 years of contributions to private retirement accounts, that retiree would have lost nearly $30,000 in retirement funds because of the downturn in the stock market over the last two years.” And while retirees would face the risks inherent in the market, according to a 1997 analysis their Wall Street money managers would reap an estimated “$240 billion in fees during the first 12 years of a privatization scheme- this number is undoubtedly much higher now.” And all the while, the Social Security Trust Fund which currently helps offset the yawning federal budget deficits would be depleted by trillions over the next several decades. All of which is why the 2012 Republican presidential field determined to undo the Social Security safety net that kept 14 million American seniors out of poverty last year is offering variations on a theme. Pizza mogul Herman Cain had touted the ” Chilean model ,” despite that that program’s rising subsidies required to keep half of the country’s retiring workers out of poverty. For his part, Rick Perry is touting the retirement plan of Galveston, Texas , which has similarly failed to provide lower income employees with the baseline of retirement benefits provided by Social Security. And Mitt Romney , despite his past fondness for private accounts , now claims he does not want to divert money from the current system. Given the personal risk and national red ink that Republican Social Security privatization schemes necessarily entail, selling the GOP’s scary math to a skeptical public is a challenge to say the least. That’s why Congressional Republicans led by then Senator Rick Santorum came up with some handy talking points in 2005 to close the sale. “Talk about how much more money they’d have for retirement if they themselves had been investing in a personal account all these years,” the GOP privatization sales kit counseled Republican officeholders, remembering all the while that: “Your audience doesn’t know how trillions and billions differ. They know these numbers are large, but not how large nor how many billions make a trillion. Boil numbers down to ‘your family’s share.’ Also avoid percentages; your audience will try to calculate them in their head–no easy task while listening to a speech–and many will do it incorrectly.” Put another way, Republicans hoping to privatize Social Security will rely on that time-tested GOP strategy: You can fool some of the people all of the time, and that’s our target market. (This piece also appears at Perrspectives .)

Link:

Republicans Call for Gutting Social Security, Adding Trillions to Debt