Repossession hotspots revealed

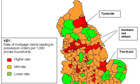

Shelter report shows link between house repossessions and unemployment More than 60 areas have been dubbed “repossession hotspots” in a report by housing charity Shelter , with Corby in the east Midlands named the place with the highest proportion of homeowners at serious risk of losing the roof over their head. The research shows the local authority areas in England with the highest proportion of homeowners issued with a possession order, and therefore at serious risk of repossession. Rising unemployment during the recession has led to a steep increase in repossession orders against homeowners this year. Shelter said the blackspot for repossessions was in Corby, which had the highest rate of “at risk” homeowners – 7.56 per 1,000, nine times higher than the lowest rate in West Dorset of 0.83. It was closely followed by Barking and Dagenham (6.62 per 1,000), Thurrock in Essex (6.16 per 1,000), Knowsley in Merseyside (5.68 per 1,000), and Newham in London (5.57 per 1,000). Shelter warned that the figures reflected a need for homeowners across the country to prepare for higher mortgage repayments if interest rates rise as expected later this year. Repossessions rocketed by 15% in the first quarter of the year , and the charity has found that unemployment rose by 3.3% on average in local authority areas with the highest levels of repossession orders. In comparison, unemployment rose by an average of 1.4% in areas with the lowest rates of repossession. Shelter analysed Ministry of Justice figures for repossession orders in the first three months of the year to identify the hotspots, with most grouped across the north of England, around the Wash, and the east of London leading out to the north Kent and Essex coast. Other hotspots include: • Fenland, next to the Wash (5.04 at-risk homeowners per 1,000) • Harlow in Essex (4.85 per 1,000) • Manchester (4.63 per 1,000) • Peterborough (4.57 per 1,000). However, Corby confounds the trend: while it is England’s top hotspot for repossession orders, unemployment is relatively low at 6.4%, rising by just 0.9% in the thee years to last September. Lenders have faced heavy criticism for enabling ill-disciplined and inexperienced borrowers to take on too much debt. But Shelter’s findings indicate that the root cause of people losing their homes is loss of income through reduced earnings and unemployment. Shelter’s findings are supported by data from the Consumer Credit Counselling Service , which advises struggling debtors. Of the mortgage borrowers calling the CCCS for help with their debts last year, 19% were unemployed, 28% were suffering reduced income and just 8% were over-committed on credit. Lenders applied for a total of 13,520 repossession orders in England from January to the end of March – a rate of 0.73 claims per 1,000 households – while unemployment rose by 2.9% to an average of 7.8% during the three years to September 2010, according to the latest unemployment figures by local authority published by the Office for National Statistics. Although the unemployment rate dropped slightly in England to 7.7% for the three months to April, it is expected to rise sharply later this year as public sector job cuts feed through, with a further rise in repossessions anticipated. Campbell Robb, chief executive of Shelter, said: “This research paints a frightening picture of repossession hotspots across the country where homeowners are on the brink of losing the roof over their head. “We know only too well that the combined pressures of high inflation, increased living costs and stagnant wages are really taking a toll on people. All it takes is one thing like job loss to tip people over the edge and into the spiral of debt, repossession and ultimately homelessness.” Repossessions Property Borrowing & debt Unemployment Social exclusion Housing market Housing Communities Jill Insley guardian.co.uk